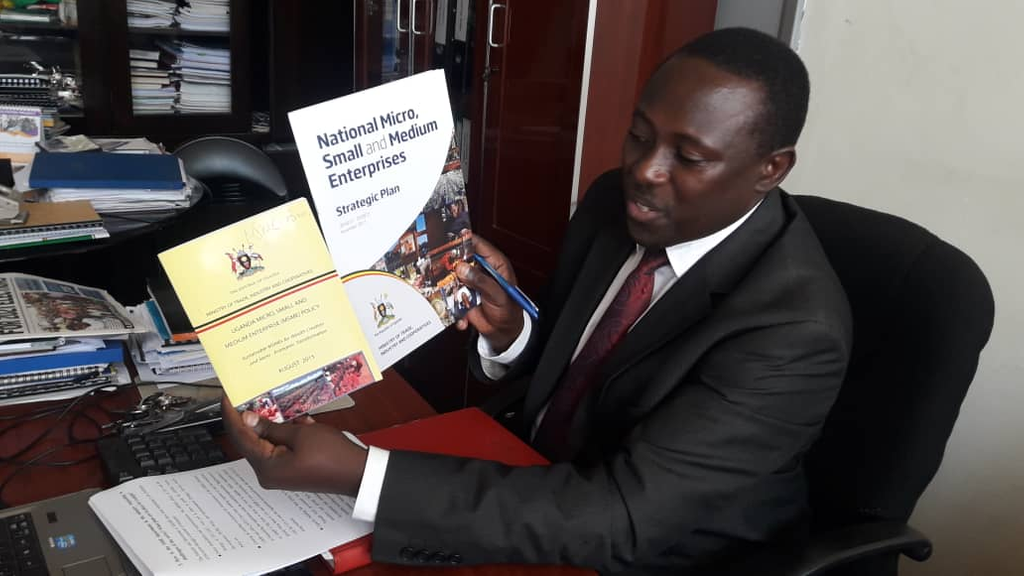

Dr. Joshua Mutambi is the Commissioner for Micro Small and Medium Enterprises (MSMEs) (Processing and Marketing) in the Ministry of Trade, Industry and Cooperatives.

He represents the Ministry on the Board of the Uganda Investment Authority (UIA). In an interview with David Muwanga, he advises on how MSMEs can access capital in the post-COVID-19 period.

What is Uganda’s SME sector comprised of?

Over 90% of the entire private sector are SMEs, over 80% of manufactured output and account for 75% of the GDP, with over 50% informal.

Over 8.5 million people equivalent to 90% of total non-farm workers of the entire private sector. 49% in the service sector, 33% commerce and trade, 10% manufacturing and 8% in other fields.

How has the COVID-19 pandemic affected this sector?

The pandemic caused disruptions in domestic and International demand and supply chains of goods and services and many people have lost jobs.

The tourism sector was hit hardest in tourists’ transport and tour guides, hotels and restaurants and their supply chains, the farmers and Agro-processors involved in processing fresh and dried fruits and bananas for domestic and export markets.

Others included sports and entertainment, cross border traders, fishing activities, and mining artisans. Most MSMEs have lost operational capital in the Stay Home Stay Safe campaign against the pandemic and cannot now service their loans.

However, a few sectors made gains such as Mobile Financial services;

Why is it that SME in Uganda never celebrate their fifth birthday?

Majority of businesses are started as a reaction to either lack of a job or after retirement or as a side business while on job without any feasibility studies and or experience.

As a result, many remain informal while those who formalise complain about high taxes. Others are also affected by limited access to credit and high interest rates. Many banks are providing financial products to SMEs, but for them to qualify for credit is difficult as they lack collateral.

Many of these entrepreneurs don’t keep records of their transactions; one just picks money from the safe and uses it without accountability due to poor business management and development skills, access to markets and market information due to high quality product market requirements and high cost of the products.

Many entrepreneurs lack appropriate and efficient technologies and experience high production costs caused by high electricity tariffs. Many of them don’t take time to innovate, you find them all selling similar goods that makes then uncompetitive.

How can SMEs access government funds in the banks?

Government has allocated Shs1trillion to capitalise UDB in the financial year 2020/21. This is to enable large businesses and SMEs in Manufacturing, agro-processing and Agribusiness to access affordable loans with minimum interest ranging from 10% to 15% depending on the risk level.

The SMEs will be trained on how to estimate the risks involved in the businesses before deciding to borrow the funds.

However some businesses may not need to go for loans but to form partnerships with suppliers of the raw materials and other inputs such as on an understanding that after processing and sales, they pay their suppliers as the business continues to grow. Hence, a need for honest and transparency in business management and transactions.

- Another option is through their Associations, Clusters or SACCOs. The Association executives can borrow as a block on behalf of their members. It has been done before. The Cooperatives have been borrowing from Micro-finance Support Center or Uganda Cooperative Alliance or UCUSCU and as they service the loans, they get more especially for small loans. There is however, need for more short term funding through their Associations, SACCOs and Private sector Organizations.

- Government also capitalized UDC for projects where private sector finds it difficult to invest alone. Enterprises with potential industrial businesses can also approach UDC for partnerships, if the investments require sizeable capital.

- Government has also given funding for innovators through MSTI, MICT and Universities for Research and commercialization of innovations

- They should take advantage of Tax Amendments that will enable them compete in both local and regional markets if their products meet the quality requirements.

- The ministry is currently compiling all those that who want to access the funds. We shall give them the necessary advice before we recommend them to the Bank.

What types of SME qualify for this money?

All formally, registered SMEs in Agriculture, Processing, manufacturing, Services sector are eligible for the loans.

However, as it is from the Bank, the business has to be appraised first. It’s not free money, therefore it should be borrowed to boost the business and therefore repay the loan.

The business will have to fulfil some conditions of the bank. The owners of the business need to be in the business already.

How is the SME department responding to challenges of the sector?

We have responded to the challenges of the sector through a number of strategies:

The MSMEs Policy of 2015 and the Strategy of 2017-2021, the BUBU Policy and Implementation Strategy and the Services Sector Policy are all in place to guide the sectors’ development.

The Ministry URSB, URA KCCA created an enabling environment for formalization of the SMEs using the simplified approaches while online registration is being done in UIA.

All government ministries, departments and agencies through district officials train individuals and group’s business development and management and advised to form SACCOS for more benefits including access to capital and some basic processing equipment.

With support from academia, private sector, development partners and UIA, we facilitate formation and training of clusters in preparing business plans, grant proposals and in manufacturing techniques like fabrication and welding, fishing processes, handicraft making and post harvest handling among others. As a result, they have accessed funding and markets of their products.

Implementation of BUBU Policy is helping SMEs and other large companies consume and use local raw materials and services. It has increased local content in government procurement through the reservation and preference Scheme.

As a result many local companies are making face masks, sanitizers, salt, sugar, and digital services. We encourage MSMEs to partake in the annual BUBU Expo to show case their businesses and services.

The Ministry has also developed an online Trade information Portal that helps parties interested in accessing trade information, the procedures, documentation required, fees and other related charges of import and export businesses with support from TMEA.

Through incubation centers and our common user facility centers such as TEXDA, UCPC, ULTCFC they have been supported in acquiring basic equipment and capacity building through technical assistance programs such as the UNIDO, the EU-UNDP Switch Africa Green Programme.

This created awareness and training on resource efficiency and energy management- MTIC and UCPC; TEXDA got the machinery for textiles training and fabric making; the Leather incubation Center and Satellite Design Studio supported by COMESA at MTAC is getting finalized with equipment installation. It will soon be commissioned.

Informal traders have been trained by MTAC in improving their business operations as well such as the women vendors and in other short courses. The Directorate (Processing and Marketing) in collaboration with Makerere University conducts research and product development.

Such as the Refractance Window Drying technology research and development for drying fruits and vegetables. The technology has been developed and tested in Kabanyoro. The products have been dried and testing and improving for nutrition purposes is under way.

What’s the future of SMEs?

The future of SMEs in Uganda will be determined by their ability to take advantage of government’s programmes such as the Vision 2040 and the new National Development Plan 3, that are aimed at industrialisation, job creation and prosperity for all.

It is better for them to exploit the opportunities that are coming with the infrastructure developments and plans such as the Industrial parks being established by the UIA, business incubators and cross border markets among others.

One will be able to locate a project either in rural or urban area once rural electrification and distribution is completed. This will especially stimulate investments in agro-processing and other services. The continued improvement of the roads is simplifying access to raw materials and markets.

Government is also implementing is trainings in the Business Technical Vocational and Education training (BTVET), and has refurbished five technical colleges all for skills development.

Government has also waived taxes including VAT from the Agriculture and Agro-processing machinery which will enhance agriculture and processing.

The Markets have been negotiated including the domestic, EAC, COMESA, the African Continental Free Trade Area and other international markets such as AGOA. Financial Institutions have all provided the Credit and financial products

This Article was also published in the NilePost on 24th September 20220